It’s no secret that having children can mean a great amount of savings when it comes to your taxes. The most common benefits most individuals know about are the child tax credit and the dependent care credit. These credits are wonderful for individuals with income below a certain threshold, however, they slowly start phasing out once income surpasses that year’s threshold. This is where the uncommon strategy of hiring your children in your business can benefit nearly any business owner or investor regardless of income.

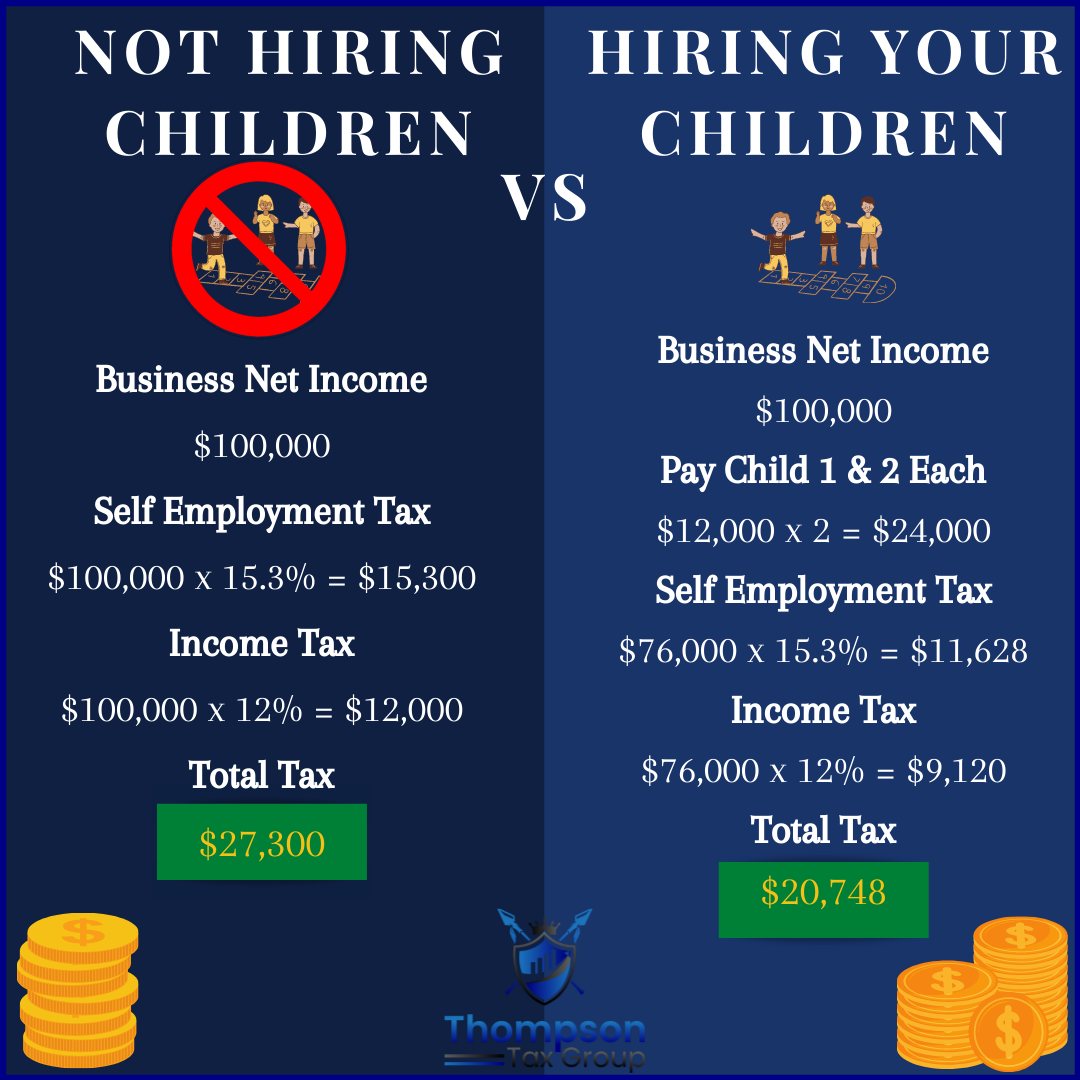

Hiring your children can provide even more benefits depending on your business entity. Take the example below, which could put over $6,500 towards your personal or business goals!

This strategy is perfect for business owners and investors that want to teach their children hard work and save tax dollars at the same time. There are hurdles you must overcome to ensure you qualify for this strategy when hiring your children. As always, we recommend working with a professional before implementing any tax strategies.

This strategy is perfect for business owners and investors that want to teach their children hard work and save tax dollars at the same time. There are hurdles you must overcome to ensure you qualify for this strategy when hiring your children. As always, we recommend working with a professional before implementing any tax strategies.